With decades of experience in B2B software application investing, Catalyst is captivated by the productivity advancements and emerging use cases powered by a maturing AI ecosystem.

With decades of experience in B2B software application investing, Catalyst is captivated by the productivity advancements and emerging use cases powered by a maturing AI ecosystem.

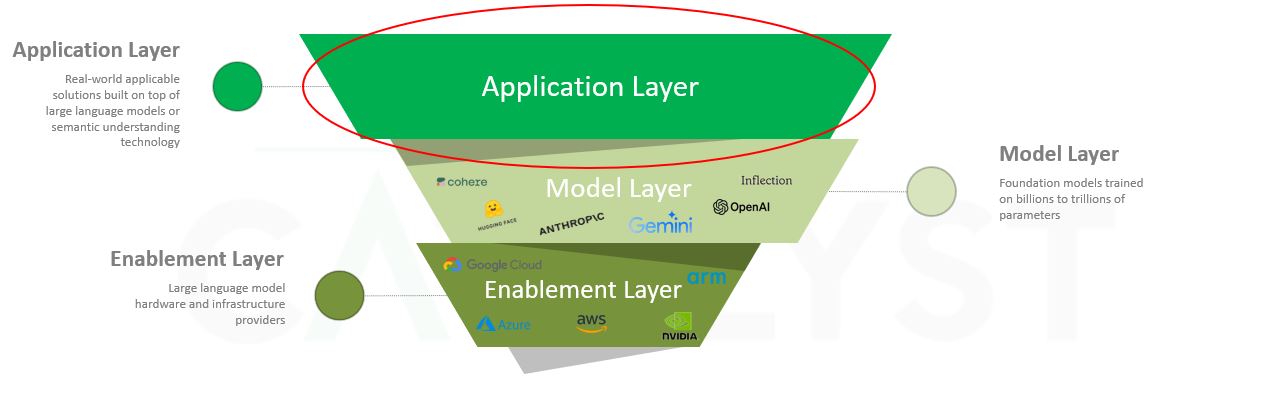

With the benefit of hindsight, we believe the AI landscape will follow a similar trajectory to the internet. Most of the value will start at the enablement layer but, over time, it will shift to the applications due to a reduction in compute costs and enhanced integration tools. The following details why we are laser-focused on the application layer, what we’ve learned from existing AI applications in our portfolio and what we’re most excited by moving forward.

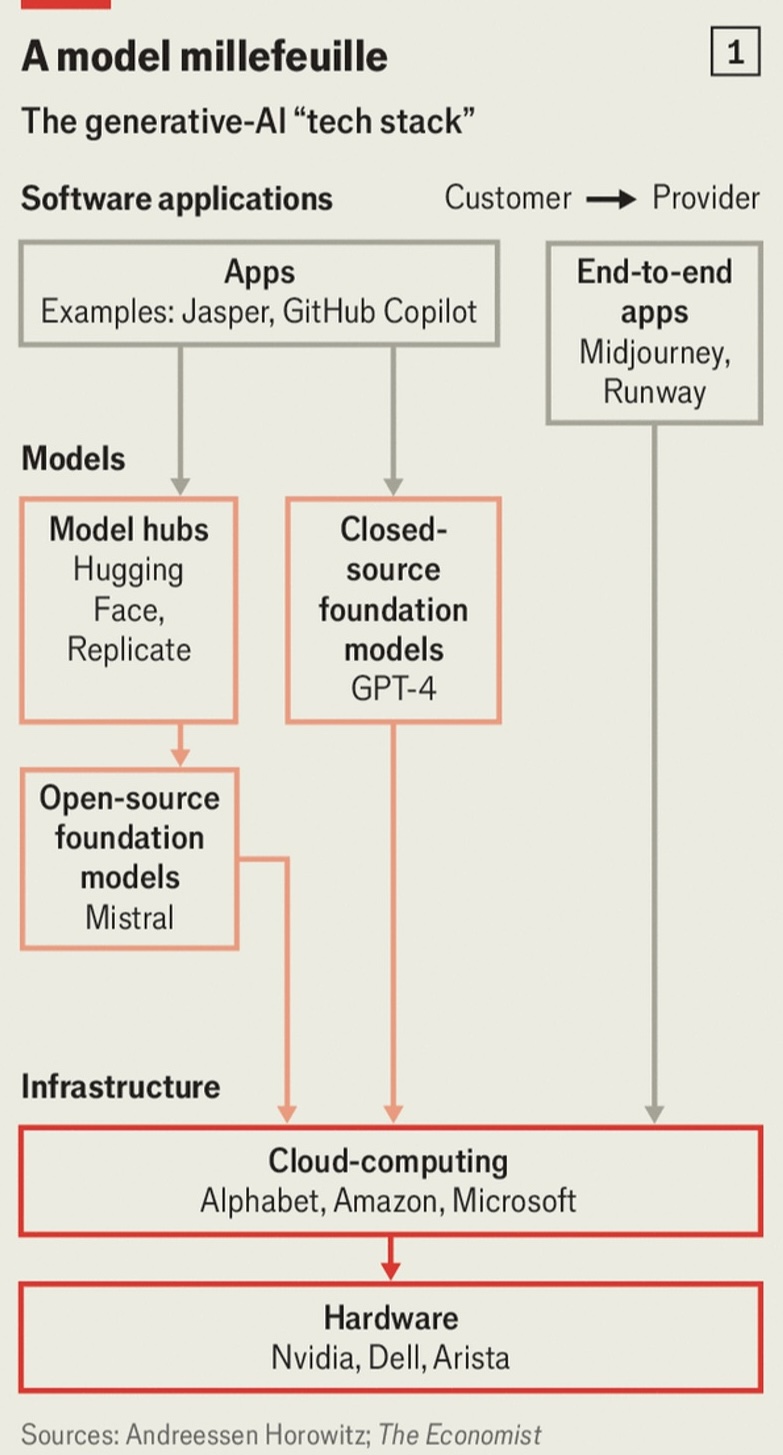

This diagram from Andreessen Horowitz & The Economist furthers our inverted triangle illustration of the landscape, with the enablement layer of “Cloud-computing” & “Hardware” supporting the growth of models and software applications respectively. The remarkable increase in capabilities and subsequent demand for GPUs (the chips made by Nvidia) has set the stage for a booming VC market for AI applications.

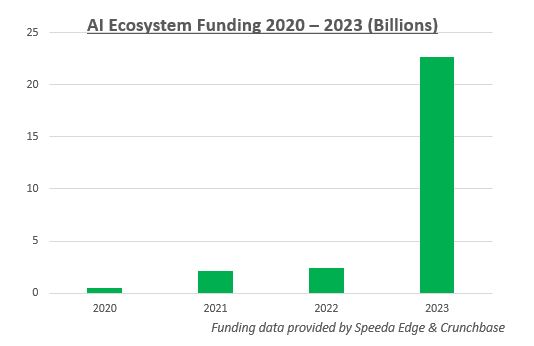

Despite an otherwise slow venture market in 2023, AI investing was a bright spot with $22.7B in capital raised. This was an increase of 9x year-over-year and accounted for 23% of total venture funding. If you exclude these rounds, venture funding was down 49%. Additionally, investment in foundation models (GPT-4, LaMDA, Llama 2 etc.) rose by 17x, setting the stage for the swift development of application layer businesses to continue in 2024.

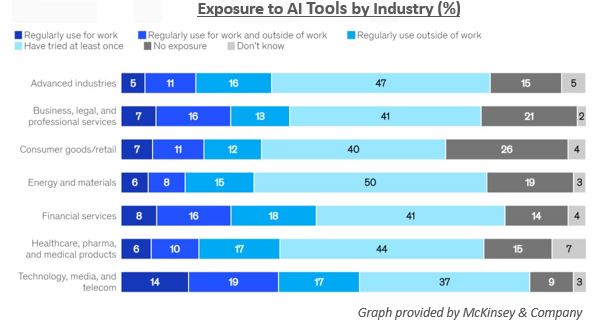

From a business operations perspective, increases in AI usage have been felt across organizations. IT budgets will expand significantly in 2024 with cloud and AI-driven spending projected to climb by more than 20% according to Wall Street estimates.

While level of engagement varies, AI experiments are being run in all industries. Today, the Technology, Media, and Telecom (TMT) sector is leading the way in regards to AI usage in daily workflows but an awakening occurred in board rooms everywhere largely stemming from the hysteria surrounding ChatGPT and other natural language processing (NLP) chatbots. For growth investors, the space cannot be ignored as the AI economy matures from exploratory to customer-driven.

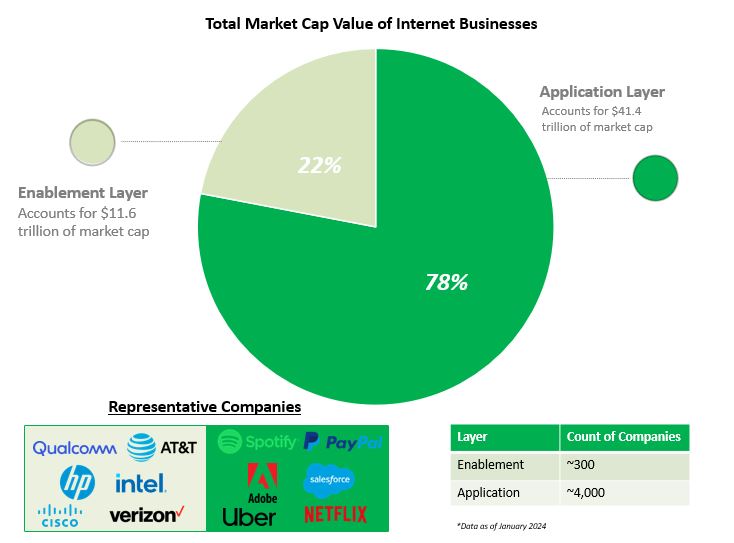

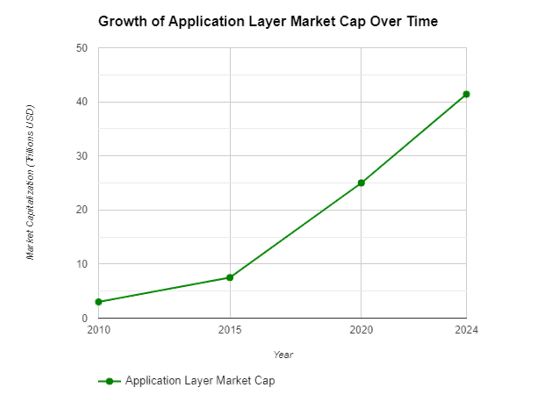

As was the case with the internet, application layer businesses present the largest opportunity for investors (both in market cap value and sheer volume). There can only be a handful of dominant enablement layer companies but there’s an almost infinite number of applications possible from harnessing advancements in a new tech frontier.

The growth of the internet’s application layer has been exponential and there is still significant value to be created with AI as a driving force behind future innovation.

Given the significant volume of AI application layer businesses set to come to market, it is imperative to have a framework to determine the viability of such solutions in their respective markets. At Catalyst, we have already invested in AI-first application layer businesses, like Burro in robotics and LinkSquares in legal, and we are excited to continue to discover and partner with transformative companies that have both deep technical prowess and a proprietary market advantage or insight.

We believe AI enables a supercharged vertical technology industry, we are most excited by:

Automating the mundane, repetitive tasks that were left unchanged by the first decade+ of SaaS applications: LinkSquares is an AI-powered contract lifecycle management platform automating complex document workflows and negotiations for in-house legal teams. They have drastically cut down on time-consuming, headache-inducing legal workflows and have an exciting roadmap ahead to help their customers flourish even more through continued advancements in AI.

The opportunity for AI-enabled robotics to augment labor-heavy industries: Burro is an autonomous outdoor mobility robot that harnesses the power of AI to solve complex outdoor inconsistencies. Their initial use case is for the agriculture industry where they optimize performance for farm workers by cutting down on transport times and radically increasing output. Burro’s robots have driven over 75,000 miles (3 laps of earth) creating a significant, defensible mobility advantage.

While difficult and certainly not all-encompassing, we are able to distil our main takeaways from our experience in the AI ecosystem to:

- AI will enable laggard industries to realize the full potential of technology

- We have seen it firsthand in legal and agriculture, but we are also excited by the rise of applications in, but not limited to, manufacturing, education, construction and supply chain management.

- AI will enable the transformation of complex physical world processes

- Burro has demonstrated the immense opportunity to rethink and supplement existing labor-heavy processes to boost efficiency. This broad concept will ultimately be an enormous TAM, including infrastructure assessment, construction and maintenance, amongst many other applications.

- AI will uncover and propel nascent sectors in the traditional software world

- We are at a unique point in time where human capacity and productivity can and will be reconsidered and job descriptions will change – AI will be the force behind these developments and the new business models that come as a result.

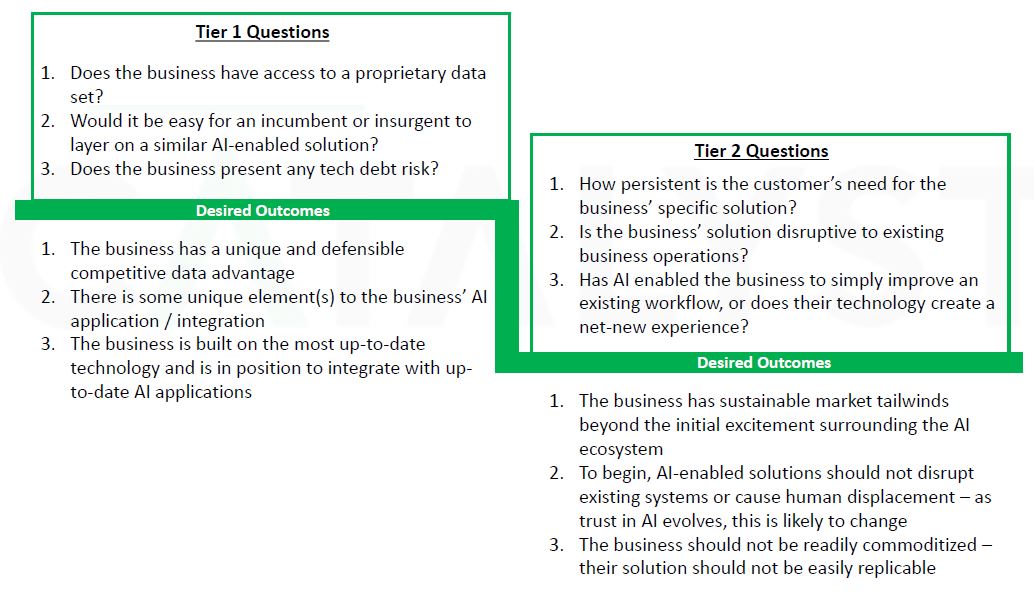

To properly evaluate AI opportunities, we have created the ensuing framework of broad questions to serve as a guide for discovering and diligencing defensible AI solutions:

We believe that 2024 will start the transition from “AI for x” businesses to customer-first solutions. A welcome maturation in an ecosystem that is undoubtedly changing the way we live and work spurred by the growth of the enablement and model layers. As was the case with the rise of the internet, with time, most of the value will shift to the application layer despite Nvidia’s seemingly constant surpassing of milestones in this current period. There’s an enormous amount of capital being invested in applications, and the opportunity set ahead is both massive and underdeveloped. Ultimately, the path leads to AI’s ubiquitous use.

We look forward to playing a role in this exciting time for technology and to the partnerships we will form with visionary management teams building more high-functioning industries.

Sources:

Sources: (1) Speeda Edge, Funding Analysis 2023: The GenAI Takeover; (2) Forbes, Top AI Statistics And Trends In 2024; (3) McKinsey, The State of AI in 2023: Generative AI’s Breakout Year; (4) Flybridge, Third Wave of AI Investing: A Future Woven with Intelligence; (5) Fortune, AI Will Spur a Tidal Wave of Spending in 2024 and Fuel a Bull Market Bonanza; (6) S&P Dow Jones Indices; (7) McKinsey Global Institute; (8) Google Gemini; (9) SmartBrief, AI is transforming law firms now – here’s how to get it right