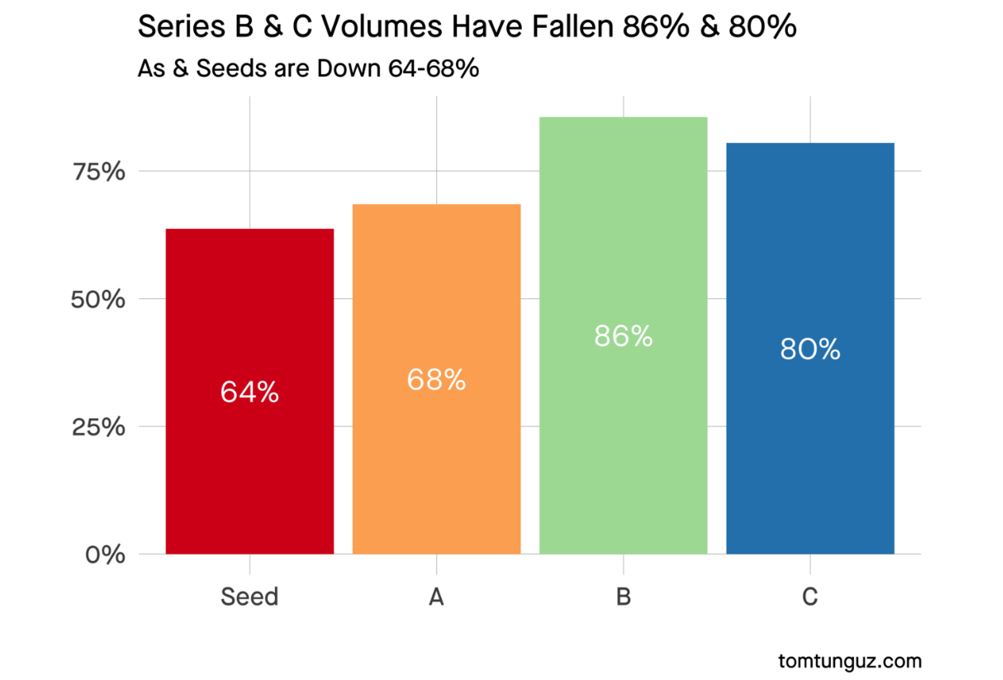

A recent post by Tomasz Tunguz highlights the huge decline in the number of venture rounds in 2022, particularly among Series Bs and Cs

Silicon Valley has swung to extreme bearishness from the extreme bullishness that prevailed during 2019 to 2021. Companies are being told to react to the bearish sentiment by having up to three years of cash runway, likely at the expense of building for the long term. The collapse of Silicon Valley Bank only exacerbates the issue as venture debt lines will become scarcer, smaller, and more expensive. Boards and founders are cutting operating cash burn as if the markets are never coming back, yet inconsistently, refusing to raise new equity until the boom times return.

The boom period of 2019 to 2021 was an anomaly. We are not going back there anytime soon. It was the blow-off top to a long bull market, turbocharged by pandemic-driven free money. VCs invested too much money at unsustainable valuations and companies spent too much money by hiring too many people. The efficiency of capital declined as the “Burn Multiple” (the ratio of net burn to net new ARR) of most companies became much higher than pre-pandemic norms.

VC-backed portfolio companies are largely working to correct the spending mistakes of the boom years. They are bringing burn multiples down, working on improving sales and retention metrics, and better prioritizing investment in product. Many of these companies still have large TAMs and growth opportunities in front of them, so why aren’t they raising Series Bs and Cs more than a year since their last round to keep investing toward their long-term growth goals?

It is not because the market is bad. My firm Catalyst has been actively looking for and bidding on Series B deals, and I can vouch that a SaaS company in market with solid SaaS metrics – good ARR growth (>50%), a reasonable burn multiple (<1.5x) and decent sales efficiency (LTV/CAC >3x) – will receive multiple term sheets at robust valuations. Pre-2019, SaaS companies with good product-market fit routinely had these metrics, so we know they are achievable. Companies don’t need to be “Rule of 40,” and they certainly don’t need to be growing 50-100% with zero burn. Those types of metrics are exceptional, and always have been. A company only needs to get to a state of solid SaaS metrics to raise capital, even in this market.

These companies are holding back from the markets because their investors are unwilling to correct their mistakes from the boom years. Instead, investors are trying to protect their mistakes.

The first mistake is overvaluation. Pre-pandemic, companies with solid SaaS metrics would be valued at 6-12x revenue, with the exact multiple driven by the revenue quality, growth rate and TAM. During the boom years, companies were raising money at much higher multiples, so if these same companies want to raise today, they might have to raise a down round. The mythology that a down round sends irreparable negative signals to the market, employees, and customers is not true in this environment. Only ego deters the down round. In the long run, one down round doesn’t matter. What matters is cumulative dilution blended over all rounds relative to the value at exit.

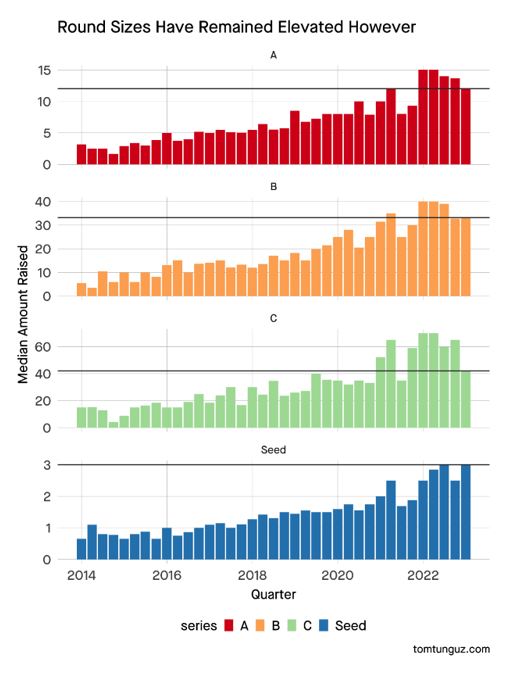

The second mistake is overcapitalization. During the boom years, round sizes (and preference stacks) ballooned. This chart (from the same blog post) demonstrates it well:

Even if valuations have come down recently, round sizes have not. Series As were typically $3-5 million pre-2019; they since increased to $10-15 million. Series Bs were $10-15 million; now they are $25-40 million. Series Cs were $20-30 million; now they are $40-60 million. The increased round sizes were driven by the increased sizes of VC funds, who encouraged companies to take more money to meet their new minimum check sizes. It would be fine if a company took 2-3x the traditional financing round size at a high valuation and ran the business “as usual”, with plenty of runway to execute. Instead, companies were encouraged to spend more aggressively to grow into their inflated valuations. I don’t have the statistics, but I doubt the growth rates of VC backed companies increased 2-3x to compensate for the massive increases in round sizes and valuations.

The third mistake is being reactive. Companies were slow to cut cash burn, hoping their metrics would turn around. They were slow to raise money, hoping the market would turn around. Many drew their venture debt lines, hoping to avoid a down round. Now many companies are doing insider-led “SAFE” notes that convert at a 20-30% discount to the next round, hoping to buy time. These decisions have collectively put a vice around companies’ necks…limiting options, starving growth and potentially increasing dilution to the founders (more on this below).

Instead, be forward leaning! Market timing is for suckers, so don’t assume the market will get better from here. Here is how we recommend companies approach this environment:

- Business strategy comes first. At Catalyst we have a saying: “The capital structure should serve the business strategy, not the other way around.” Base your capital strategy on what you want to accomplish as a business. If you care about valuation, don’t cut spending in a way that kills your growth rate. Focus on sales efficiency and revenue quality, but plan to grow as fast as you reasonably can while maintaining an LTV/CAC of >3x and a burn multiple of <1.5x. Consider constraints like how quickly you can hire, onboard and ramp staff while continuing to execute.

- Model out the capital need. Figure you need 18 months of cash – that’s a year until you raise your next round and six months of cushion. You want to spend the next year growing your revenue and investing in your product. Don’t act like it’s a land grab, but don’t assume your competitors are standing still, either.

- Raise the money as equity, even if it’s a down round. Don’t get cute waiting for the market to turn around. Go out and raise a round. If you have the metrics, you can raise money at a fair price. Will it be a down round? Perhaps. But in the end, if you raise money and your competitors don’t, you can continue to build your lead in the market (or catch up). Slamming on the brakes gets you nowhere…literally…and debt and SAFE notes increase risk for limited reward.

- Consider raising a smaller round. Dilution matters, so use the next round to correct for the last round. Think of the two rounds as one blended round. If you raised a $15 million Series A, it’s okay to raise a $10 million Series B. $25 million raised across both rounds is perfectly reasonable. Think of blended valuation the same way…look at the dilution across both rounds. By raising a smaller second round, even at a lower price, you can minimize dilution while still funding the growth of the business. Here is where SAFE notes really hurt. If you raise a down round, the SAFE notes both increase the size of the round and convert at a discount…a double whammy of dilution.

- Go out and get term sheets. Don’t rely on your VCs to help you raise your next round. Tell them you want to raise capital. If they are willing to help, great, but feel free to go out and solicit investors yourself. Bring term sheets to the board and recommend the term sheet you think is best for the company.

Look after the long-term value of your business. Don’t get caught being reactive and thinking too short term, protecting the mistakes of the past. Instead, get back to building long term value by being proactive while correcting the mistakes of the past. Raise the money.